Everybody wants to access easy loans whenever he or she has an emergency. Access to quick loans has not been easy but thanks to technology because now you can process a loan and have the cash in your hands within a few hours. Instant online loans have proven to be helpful in times emergency than any other form of borrowing. But to qualify for this 1 hour loans you need to have a good credit record and a job. There are government bodies that monitor credit score for different individuals. This online lending platform work hand in hand with this registration firms to make sure that an individual is qualified for a loan. Therefore to have access to this quick loans you should make sure you are on the right books. If you are trying to access a loan, here are some tips for choosing a online loan website.

Processing period

Whenever you have an emergency, time is of the essence. You need access to funds as soon as possible. Online lending sites have proven to be reliable, most can give you a loan in a matter of hours. This gets better with time because after the first few transactions you will be able to get a loan within a few minutes. However, you should know your preferred online lender’s loan processing period in case of an emergency.

Repayment period

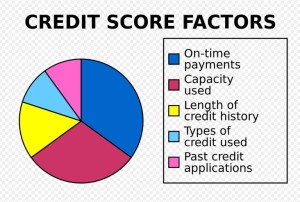

Before you accept the cash, you need to know the repayment period. You should always pay your loan on time. Paying on time improves your credit score, this qualifies you for more funds whenever you need them. Defaulting on a loan from one lending site may disqualify you from accessing more from other lending sites.

Interest rate

When asking for a loan, know in advance how much you are going to pay back. Different lending sites have different interest rates. The rates also increase depending on the duration you will take to pay back your loan. You should choose a website with the lowest interest rate. And always make sure you pay within the shortest time possible.

In case of defaulting

It is always good to be prepared for the worst. Know that if you default on paying back your loan, your credit score will be affected. When you are about to default on payment, and you are not sure of what to do, just call your lender’s customer care and ask them to extend your payment period. However, this will be at an extra cost to you.